Projects Portfolio

Quant Trading Research Lab

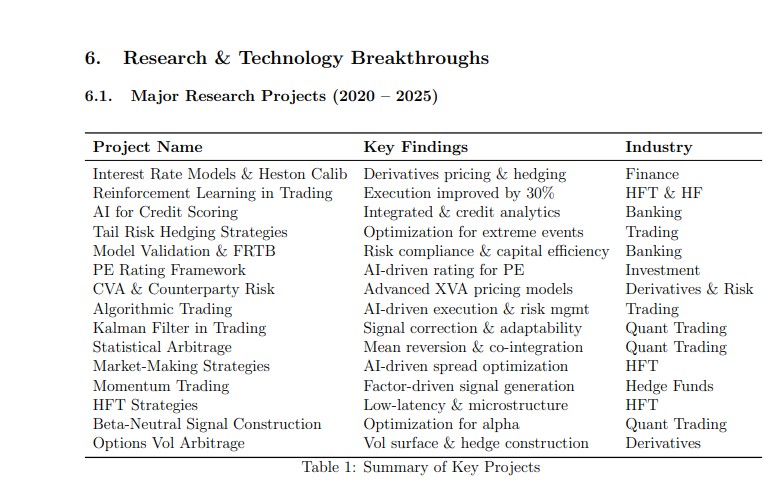

The Quant Trading Research Lab (QFCM Lab(bootstrap)), active from Aug 2020 to Feb 2025, focused on developing, validating, and deploying cutting-edge quantitative models and trading strategies across multi-asset portfolios. Leveraging stochastic processes, Monte Carlo simulations, and machine learning, the lab specialized in market risk analytics, derivatives pricing, and dynamic hedging under realistic macroeconomic and stress scenarios. The research supported risk-adjusted alpha generation in alignment with regulatory frameworks.

Project Timeline (2020 – 2025)

| Period | Quant Trading Projects |

|---|---|

| 2020Q3 | Development Credit Risk Models for trading book exposures |

| 2020Q3 | COVID-19 stress testing applied to quant trading risk factors |

| 2020Q3 | Interest rate scenario simulation for hedging strategies |

| 2020Q4 | VaR & CVaR Monte Carlo engine for multi-asset trading portfolios |

| 2021Q1 | Merton-KMV framework implementation for CDS pricing and hedging |

| 2021Q2 | FRTB P&L Attribution Prototype integrating quant trading risk factors |

| 2021Q3 | Cross-asset Monte Carlo pricing library (C++), Greeks calculation |

| 2021Q4 | Volatility surface calibration for options trading strategies |

| 2022Q1 | Integration of GHG emissions risk in trading portfolio scenario analysis |

| 2022Q2 | CDO basket pricing with t-Copula Monte Carlo simulation |

| 2022Q3 | Explainable AI-driven credit score |

| 2022Q4 | Tail risk hedge simulation incorporating macroeconomic shocks |

| 2023Q1 | Streamlit dashboard for climate risk and trading portfolio stress testing |

| 2023Q2 | Proxy hedging framework for illiquid credit exposures |

| 2023Q3 | Calibration of G2++ and Hull-White models for swaption trading |

| 2023Q4 | LSM-based Bermudan swaption pricing and hedge testing |

| 2024Q1 | ARIMA-driven CDS spread forecasting for dynamic trading signals |

| 2024Q2 | Credit-market integrated VaR & CVaR risk simulator |

| 2024Q3 | 3D simulation project (algorithmic trajectory optimization) |

| 2024Q4 | Quant model risk dashboard and validation |

| 2025Q1 | Real-time dynamic hedge efficiency analyzer with scenario input integration |